- Product

Product

MATRIXX PlatformCommercial Benefits

Rapid Commercial InnovationCustomer-Centric SolutionsUnified, Real-Time RevenueDynamic Operational FlexibilityTechnical Benefits

High Performance Core5G CHF | CCS ArchitectureAPI-FirstClick-Not-CodeTrue Cloud NativeUnified Commerce- Opportunities

Market Segments

ConsumersSmall and Medium EnterpriseLarge EnterpriseGovernment NetworksPrivate Cellular NetworksWholesale- Customers

Overview

Success HighlightsBusiness Case Studies

DISH - Standalone 5GLiberty Latin America - Group TransformationOrange Romania - Rapid Brand InnovationTelefónica - Converged ChargingTPG Telecom - Multi-Brand StrategySuccess Stories

iD MobileOne NZ - ConsumerOne NZ - EnterpriseOrange PolandStarHubSwisscomTata CommunicationsTelstra- Partners

Be A Partner

Partner Program OverviewPartner Resources

Education & TrainingStrategic Initiatives

Blue Planet | Dynamic Monetization of 5GGoogle | Confidential ComputeIBM | Telco Cloud PartnershipMicrosoft and Blue Planet | Monetize 5G ExperiencesRed Hat OpenShift | Hybrid CloudSalesforce | Digital ExperiencesPartner Case Studies

AWS CI/CD Pipeline- Resources

Events & Webinars

Register ITW 2024: Join CTO Marc Price for a panel discussion on AI disruption, May 15thWebinars On-Demand- Company

From B2B to B2$$: Experience and a New Growth Agenda in Telco Enterprise Services

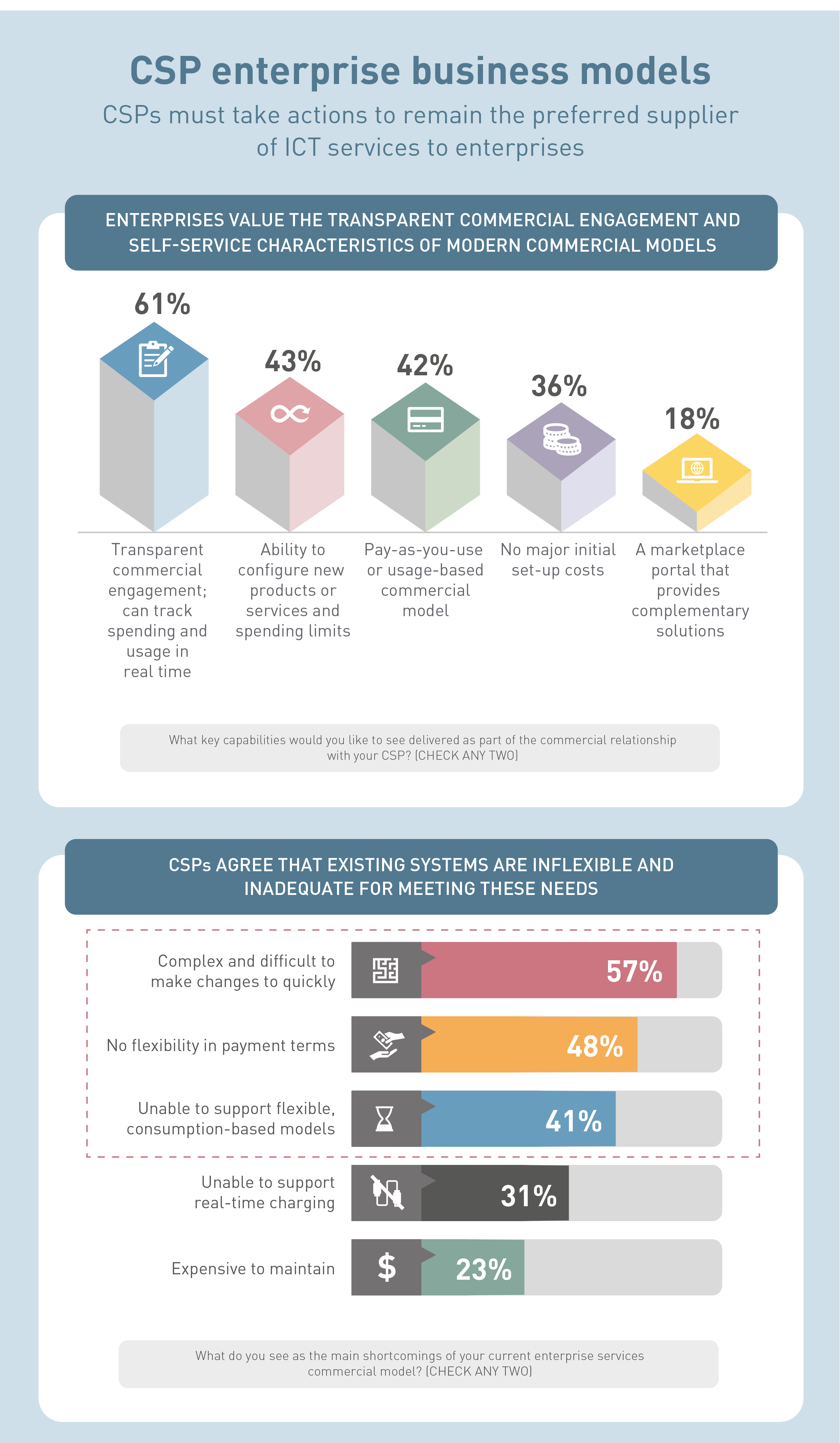

Paul GainhamApr 01, 2022 B2BIn early 2022, MATRIXX Software commissioned Analysys Mason to undertake a survey of telcos and enterprises globally with a view to capturing insights and thoughts specific to the commercial relationship that exists between them. That study interviewed some 60 telcos and 300 enterprise organizations, asking for views on the current commercial relationship, whether that met current or future business and operational needs and what actions might be taken if changes were required.

You might ask why commission such a study now? With consumer business relatively flat or low growth, the spotlight from telco shareholders and the telco C-suite is on enterprise business to plug the growth gap. The enterprise communication services business (excluding IT services such as cloud and security) is worth approximately $350 billion per annum to telcos according to Gartner. The good and bad is that not only is it a large revenue earner, it’s also one that — with the arrival of new technologies such as 5G, edge computing and Network-as-a-Service — offers a major growth opportunity, for someone.

The challenge for telcos is that someone, increasingly, may be other players.

The infographic above shares key stats from the full report, CSPs B2B Success Will Be Defined by the Flexibility of their Commercial Models.

Growing Competition

Those players could well be the hyperscalers, new private cellular network players, vendors and SIs, all of whom are viewing the technology disruptions outlined as a potential means of grabbing a significant piece of that $350 billion pie and potentially disintermediating telcos in the process.

That clear and present risk is one telcos need to be fully aware of and have a clear strategy as to how to respond to and get ahead of it.

In a previous blog I highlighted the huge importance of the SME segment, given that it is over 50% of the enterprise opportunity space and thus a massively important segment in which to establish a leadership position.

If telcos are to successfully fend off increasing competition and grow their share of overall enterprise business, the dynamics of the commercial relationship and experience delivery become THE key battleground and one where in most cases, telcos are behind. The SME segment is an example of where those dynamics are currently most exposed but, in fairness, it’s an enterprise-wide issue.

So, in commissioning the survey with Analysys Mason now, our goal was to see if those concerns were mirrored by enterprise decision makers and whether telcos saw the same issues and were acting on them, or if both parties were mostly happy with how things were.

Key Takeaways

Key findings of the report include:

- A significant percentage of enterprises are frustrated by pricing complexity and limited transparency in the commercial relationship with telcos and are looking for greater ability to drive the relationship via increased self-help service delivery.

- A significant percentage of telcos recognize that existing systems are restricting the ability to deliver those requirements, often being too complex and lacking flexibility or agility to change.

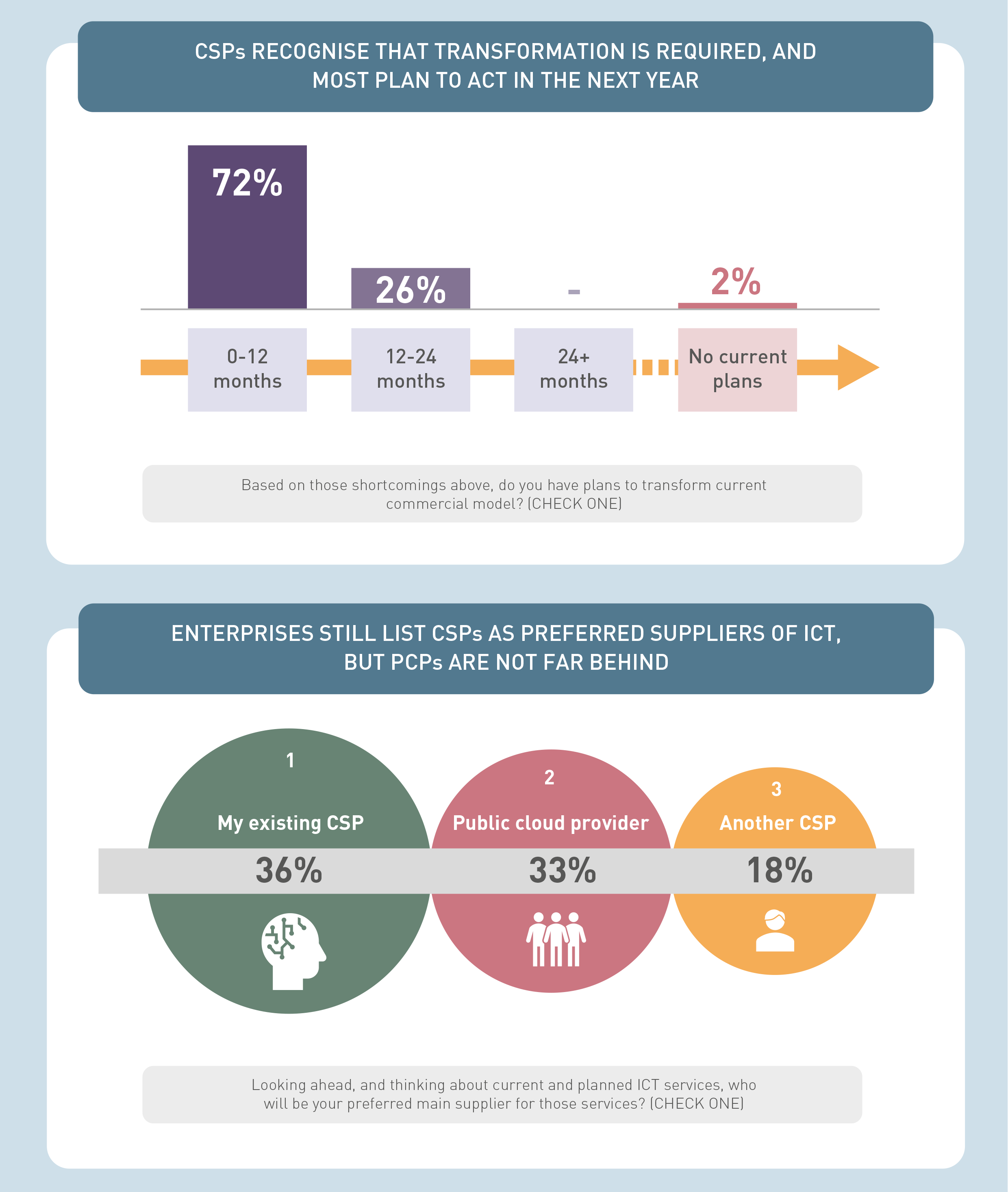

- Only 21% of telcos interviewed believed the current commercial relationship and model in deployment with enterprises was fit for purpose, suggesting a clear need for change, with 72% of telcos suggesting the changes needed were being considered in a 12 month timeline.

- Good news is that the enterprises interviewed still saw telcos as a preferred supplier of ICT services, however, public cloud players were not far behind.

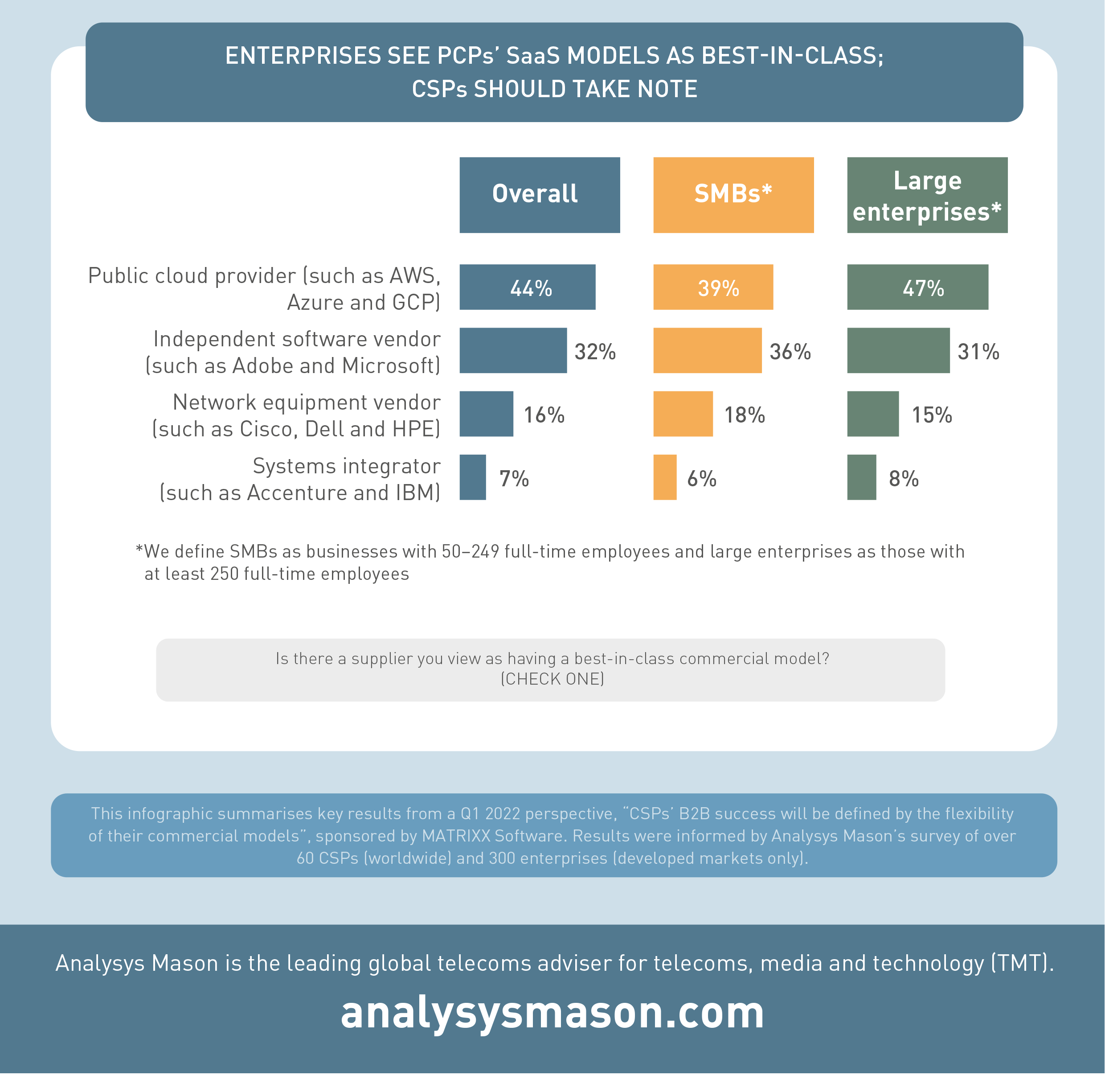

- Underpinning the closing of the gap between telcos and public cloud players, a number of the enterprises interviewed viewed the commercial model of the public cloud players as best in class.

It becomes increasingly apparent that in the race for sustainable growth in enterprise managed ICT services, the current and future battleground for hearts, minds and wallet share is centered around the commercial model and rich experience delivery. Getting those dynamics right and driving a breakthrough, new digital agenda is long overdue.

Pin It on Pinterest

- Opportunities