- Product

Product

MATRIXX PlatformCommercial Benefits

Rapid Commercial InnovationCustomer-Centric SolutionsUnified, Real-Time RevenueDynamic Operational FlexibilityTechnical Benefits

High Performance Core5G CHF | CCS ArchitectureAPI-FirstClick-Not-CodeTrue Cloud NativeUnified Commerce- Opportunities

Market Segments

ConsumersSmall and Medium EnterpriseLarge EnterpriseGovernment NetworksPrivate Cellular NetworksWholesale- Customers

Overview

Success HighlightsBusiness Case Studies

DISH - Standalone 5GLiberty Latin America - Group TransformationOrange Romania - Rapid Brand InnovationTelefónica - Converged ChargingTPG Telecom - Multi-Brand StrategySuccess Stories

iD MobileOne NZ - ConsumerOne NZ - EnterpriseOrange PolandStarHubSwisscomTata CommunicationsTelstra- Partners

Be A Partner

Partner Program OverviewPartner Resources

Education & TrainingStrategic Initiatives

Blue Planet | Dynamic Monetization of 5GGoogle | Confidential ComputeIBM | Telco Cloud PartnershipMicrosoft and Blue Planet | Monetize 5G ExperiencesRed Hat OpenShift | Hybrid CloudSalesforce | Digital ExperiencesPartner Case Studies

AWS CI/CD Pipeline- Resources

Events & Webinars

Register ITW 2024: Join CTO Marc Price for a panel discussion on AI disruption, May 15thWebinars On-Demand- Company

Private 5G Networks: Threat or Opportunity?

Paul GainhamJan 22, 2020 PRIVATE NETWORKSLooking through the rear-view mirror, when 5G started on its journey towards the “peak of inflated expectations,” many industry watchers were predicting it would drive a revolution in enterprise opportunities. In the midst of that revolution, an interesting set of discussions and actions have risen around the subject of private 5G networks.

What’s Happening with 5G Private Networks and Why?

In the context of 5G, the focus is around the delivery of a dedicated mobile network infrastructure solely for (typically large) enterprise usage. How that is delivered is the source of much debate and some divergence of opinion. Organizations, such as Bosch and Volkswagen, have publicly indicated interest in pursuing this approach and often quote security, control, choice, flexibility and cost as their main business drivers. The message being received is that those considering this path believe the public, licensed 5G networks and telcos will struggle to deliver these attributes to the levels that enterprises think they need.

To execute a private 5G mobile network is no small feat. From frequency planning and aerial deployment to the radio backhaul network, the core and integration into existing IT systems is a complex challenge. On top of that, acquiring a private license within the frequency range allocated by the local regulator, and then operating within the license agreement, is also an exacting task.

When taking all of that into consideration:

- Are private 5G networks an opportunity for system integrators, network equipment providers and the like?

- Will private 5G mobile networks marginalize telcos?

- How can telcos make full use of their 5G investment?

Let’s find out.

Is There a Role for Telco in Private 5G Networks?

In uncovering the scope of opportunity for telcos in this space, it pays to look at the possible delivery options, their pros and cons and how much a telco may need to shift its focus to capitalize on that opportunity. It goes without saying that by investing billions in public 5G licenses and infrastructure build-out, telcos will want to sweat out that asset quickly by attracting and keeping devices on the public macro network.

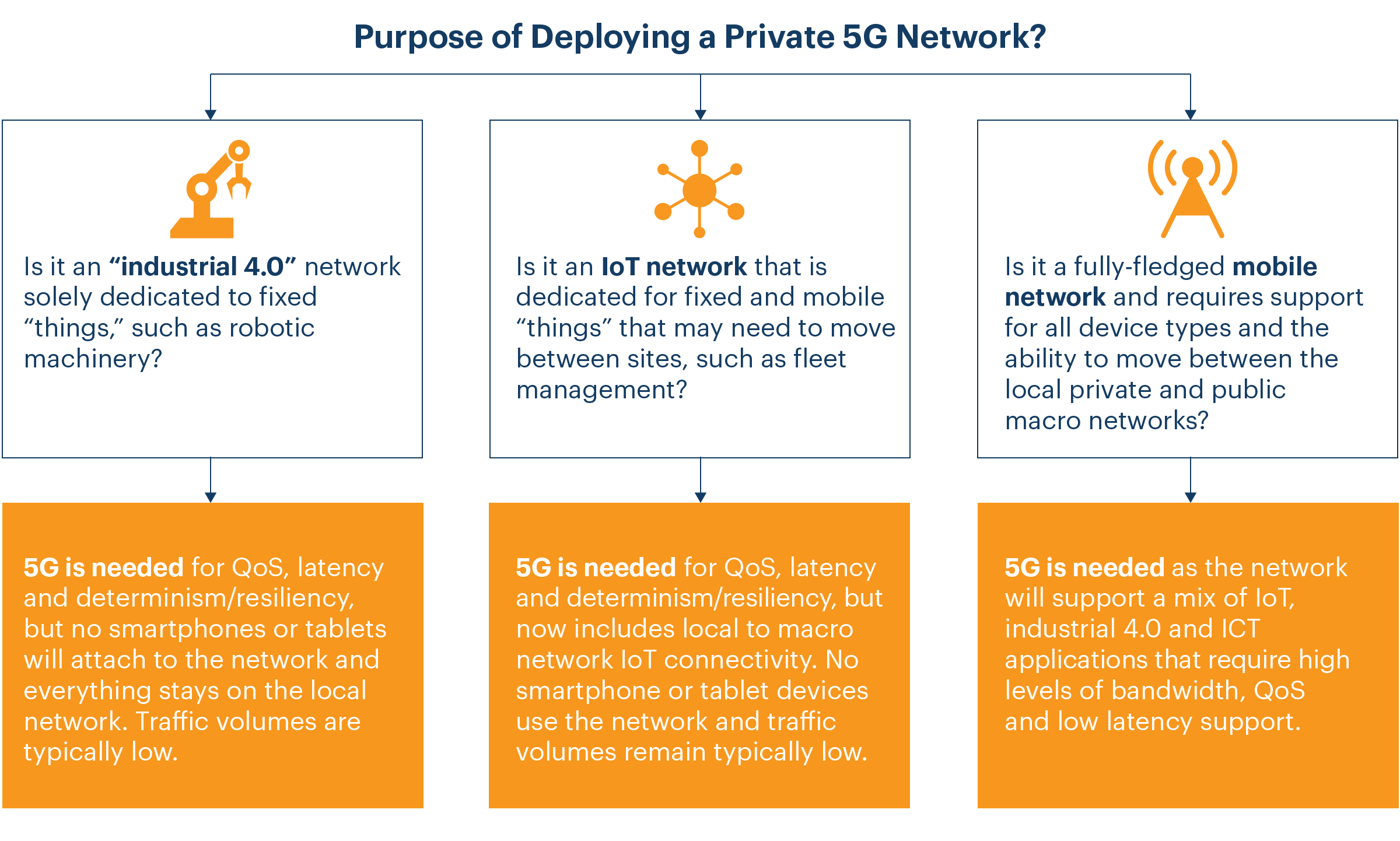

In breaking down the possible deployment options, the first thing to consider is what the actual high-level purpose of deploying a private 5G network is.

The deployment options, their benefits/drawbacks and possible telco roles are as follows:

- Network Slicing

The telco builds on its existing fixed LAN/WAN network relationships with the enterprise — its own in-house SI capabilities and vendor partnerships to deploy a dedicated “off-shoot” of the public network on the premises of the enterprise. The appropriate small cells backhaul and base station infrastructure are deployed on-site with frequency planning, all of which become a dedicated network slice for that enterprise and can be built/sized for their specific needs. The network is homed off the telcos virtualized 5G core.This approach makes full use of the telco investment in public 5G licenses and infrastructure, supports the above models and allows traffic to roam seamlessly between a dedicated on-site infrastructure and the macro network. The on-site deployment would be contracted under an SLA, with initial build and ongoing maintenance payments, and gives the telco a great opportunity to marry the best of local and macro network integration and service offerings. - Standalone Private Network

The telco brings its expertise in mobile network deployment and operation, and with selected partners, contracts to build and operate a dedicated on-site mobile network. Appropriate frequencies from CBRS like bands would be purchased and deployed within the enterprise estate and the entity would run as a standalone mobile network under a managed service SLA contract. A local roaming interface (regulator permitting) would exist between the private and specific telco macro network, opening up extended monetization opportunities.The other angle to this deployment option could be the delivery of a standalone network by a neutral host company that is independent of the telco. This is a feasible option (certainly for fixed industry 4.0 type networks) for enterprises to consider. It would need multiple local roaming interfaces between the neutral host network and in-country macro networks or possibly the use of dual SIM devices (which is both limited, clunky and may not be an option for certain “things”). - Partner Network

With the advent of offerings such as AWS Wavelength, telcos may have an opportunity to consider fronting a combined 5G/distributed cloud offering into target enterprises. In many ways, this is similar to the network slicing option but has a crucial benefit for those existing AWS VPC (or similar offering) customers. As an example, this could be an attractive way of extending the usage of that offering right into the heart of the enterprise. That would help maintain application build and deployment consistency and get the full benefits of a “powered by 5G” approach.

Where’s the Money?

The “revolution in enterprise” is promising for telcos, certainly for those who want to move along the “value per bit” continuum and establish a new position in the value chain. The role of a digital connectivity and content platform, delivering the best of applications and services “powered by 5G,” is one that holds great promise. Private 5G networks will be an interesting part of that overall opportunity. Recognizing that the current enterprise experience delivered by most telcos has room for improvement is key. Recent enterprise organization research conducted by IDC points to the gap between a 5G network and a 1G user experience — a gap that needs to be closed quickly if the “revolution” is to gather pace.

Pin It on Pinterest

- Opportunities